Countdown to GE2025: Sensing Singapore’s Mood

A Blackbox Briefing on Voter Sentiment and Expectations

Singapore Community Enters Pivotal Election Year with Rising Optimism

As Singapore looks ahead to GE2025, the nation stands at a crossroads. While 2024 was marked by a historic political succession, it also witnessed a reversion to certain pre-pandemic trends. The year began with widespread economic anxiety, but by its close, Singaporeans were expressing a renewed sense of optimism. Nearly nine in ten (88%) now believe the country is heading in the right direction, a notable 11-point jump from this time last year.

This renewed confidence extends to personal finances, with four in five Singaporeans (78%) rating their financial situation as “quite good” or better—a 14-point increase year-on-year. Similarly, overall community satisfaction has risen significantly, now standing at 87%, up 13 points from the same point in 2024.

Beneath this surface recovery, however, persistent worries remain. The rising cost of living, escalating housing prices, and uncertainty over AI’s impact on the job market are key concerns for many citizens. Adding to the complexity, Singapore’s typically composed political landscape has been disrupted by high-profile scandals, trials, and controversies—an unusual departure from the nation’s trademark stability.

With these shifting dynamics at play, the upcoming election is poised to be a pivotal moment in shaping Singapore’s political and social future.

Key Social Trends Look Set to Impact GE2025

As Singapore approaches GE2025, several social trends are emerging that could significantly shape the election’s outcome. Chief among them is the persistent concern over the cost of living. While middle- and higher-income households report some relief, lower-income households continue to feel the strain, keeping this issue front and center for policymakers. Similarly, housing affordability has risen to become a top-three concern for most Singaporeans, with $1 million HDB flats becoming increasingly common—a stark reflection of escalating property prices.

Other notable shifts include the gradual retreat of hybrid work arrangements, as more employers call staff back to the office, and the continued decline of both traditional and local digital media platforms. In their place, platforms like TikTok, WhatsApp, and X (formerly Twitter) are gaining traction, particularly among younger demographics. Amid these changes, a growing number of Singaporeans are stepping up to address community challenges through grassroots initiatives, working outside traditional institutional frameworks to drive meaningful change.

These trends highlight a society in flux, grappling with evolving economic, social, and cultural shifts that will undoubtedly shape voter priorities and political narratives as the nation moves closer to GE2025.

Sensing the Views of the Electorate

Singapore’s economic landscape has shown signs of improvement in recent months, creating a more favorable environment for the government as the nation approaches GE2025. More than half of Singaporeans (54%) say that 2024 was a better year for them compared to 2023. However, this sentiment varies significantly across income groups, with only 44% of low-income households sharing this view, compared to 67% of high-income households. For those who felt that 2024 was worse, two in three identified rising costs of living as the primary reason.

Looking ahead, 57% of Singaporeans expect economic conditions to improve in 2025, though a 20-point gap persists between higher-income and lower-income households, highlighting ongoing disparities in economic confidence. While the cost of living remains the number one concern for Singaporeans—consistently ranking as the top issue across five successive quarterly waves on SensingSG since our tracking began 15 months ago, and the area where governance performance is rated the worst among 26 measures—this concern has declined by 18 points since the start of 2024, reflecting the positive impact of multiple aggressive government support measures. With headline inflation now more manageable, mid-2025 could offer a strategic window for the government to call the General Election. Waiting for expected feel-good vibes post-SG60 National Day is also a highly viable option.

Further bolstering confidence in the government, the Blackbox Good Governance Meter—which tracks perceptions of government performance across 26 core policy areas—has climbed steadily throughout the year, reaching its highest score yet of 69 by year’s end. These trends suggest that while challenges remain, the government has successfully improved sentiment among many voters, setting the stage for a potentially favorable electoral outcome.

Smooth Political Transition Keeps Leadership on Course

Singapore’s transition to new political leadership has been smooth, with Blackbox indicators showing steady approval ratings for Prime Minister Lawrence Wong. Throughout the year, his ratings have remained solid, comparable to those even of his predecessor, Senior Minister Lee Hsien Loong. Three in four Singaporeans approve of how he is performing in his role as PM, indicating confidence in his leadership, even as he has yet to make significant gains beyond this stable support base.

Senior Cabinet Ministers have also maintained strong approval ratings, seemingly unaffected by potentially controversial news stories. Meanwhile, Workers’ Party Leader Pritam Singh has experienced a dip in his approval ratings amid ongoing legal challenges. Although his approval has slid in recent months, it still stands at 63%—a respectable figure for a political figure, though 10 points behind the Prime Minister.

Interestingly, high-profile political scandals in 2024 have had little lasting impact on public sentiment. Most Singaporeans appear to have brushed these incidents aside, remaining more focused on core national concerns such as economic stability and national security, as well as everyday issues like cost of living, housing prices, and online scams. This resilience illustrates the electorate’s practical prioritisation of bread and butter issues over political drama.

How Are Voters Framing GE2025?

Voter sentiments are diverse and multifaceted. Over one in four eligible voters remain undecided for now, leaving political parties ample room to sway the electorate. Younger voters, in particular, represent a critical group, with more than a third of those aged under 30 still in play. In contrast, older voters—who increasingly constitute the majority of the electorate—have largely solidified their voting intentions.

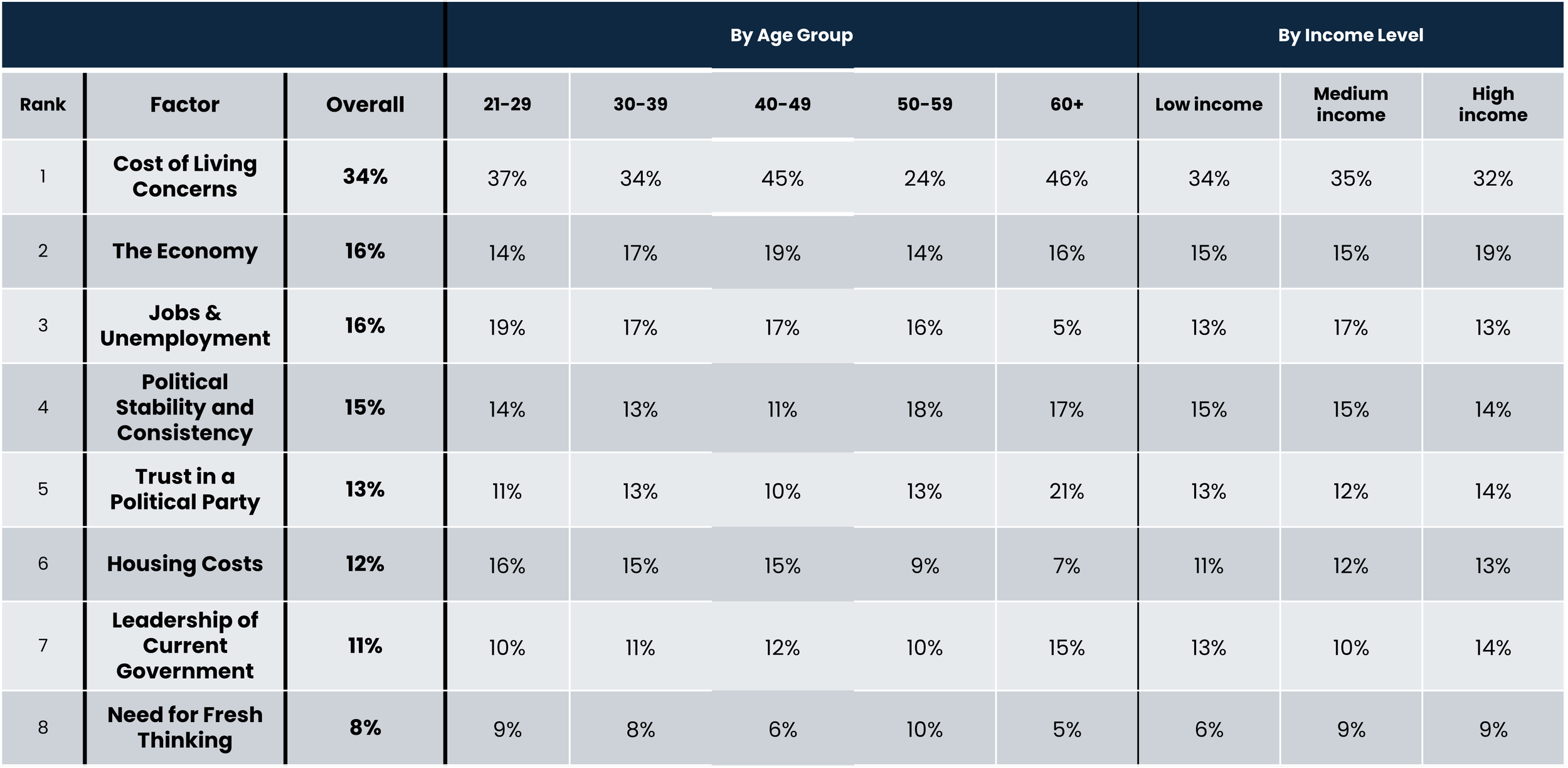

The key issues likely to dominate the election are clear: cost of living, the economy and jobs, and housing costs rank as the top three concerns among voters. Personality-driven politics, however, appears to be less of a focus at present. Interestingly, high-income earners are more likely to highlight civil rights and democracy as key topics, indicating a potential shift among highly educated and successful segments toward broader political choices.

Candidate quality is emerging as a critical consideration for voters, with 88% of Singaporeans highlighting the calibre of candidates in their constituencies as an important factor in their decision-making. This emphasis on local representation is matched by an equally strong focus on service delivery and infrastructure in their local areas, also cited by 88% of voters as a key factor. Interestingly, these local-level concerns outweigh broader issues such as the Government’s overall performance since the last General Election (85%) or even the identity of the next Prime Minister (83%).

Older voters place particularly high importance on candidate quality, while younger voters, who are more likely to be undecided, may require targeted outreach through digital platforms and social media to engage effectively. As GE2025 approaches, this heightened focus on governance at the constituency level highlights the need for political parties to field credible, capable candidates and address localised issues directly.

When it comes to overarching perspectives on the election, no single narrative prevails. When asked to select from a series of statements that most resonated with them, one in five (21%) SensingSG respondents say the PAP is the only credible choice, but the very same proportion believe that voting against the PAP will encourage greater accountability. At the same time, 18% feel it is time for a change, demonstrating a diverse array of voter priorities and motivations.

Despite these varied viewpoints, the ruling PAP retains an advantage, with most voters favoring their track record and emphasising the importance of political continuity as key reasons for their support. This blend of perspectives sets the stage for a competitive GE2025.

Everyday Economic Issues Most Likely to Sway Voters

What Can We Expect in the Coming Months?

We can expect several key developments in the coming months to shape the political landscape, although many of the moves will seem familiar.

The Government is expected to maintain its focus on easing cost-of-living pressures, given that this issue has been not only a major crystallizing factor here, but one that led to the downfall of high-profile governments worldwide in 2024. Budget 2025 will serve as a pivotal opportunity to secure voter confidence, offering the Government its last major chance to address any communication and perception gaps and appeal to segments of the electorate where support may be lacking.

Housing policy, a traditional cornerstone of the PAP’s platform, is also in the spotlight as Singapore’s real estate economics evolve alongside rising affluence. With HDB flats increasingly valued at $1 million or more, the electorate’s aspirations have shifted. Housing has become both a symbol of success and a source of envy, reflecting a tension that is likely to influence voter sentiment in 2025.

Unlike other nations, the upcoming GE is unlikely to centre on personality-driven politics. Singaporeans show little appetite for political theatre, and there is no clear charismatic figure or populist rhetoric dominating the stage. The 4G leaders of the PAP seem to recognise that tangible results outweigh grandstanding, aligning with the electorate’s pragmatic focus on outcomes over spectacle.

That said, the battle for voter attention may shift toward digital platforms. Social media, particularly TikTok and Instagram, is increasingly becoming a tool for politicians, particularly those in the Opposition, to engage voters through asymmetric tactics that bypass traditional media. However, as recent walkabout clashes between the PAP and PSP in West Coast GRC demonstrate, on-the-ground presence remains a vital factor in Singapore’s compact political arena.

Lastly, a potential wildcard when the campaign comes around is the Protection from Online Falsehoods and Manipulation Act (POFMA) and how often it might come to be deployed if and when misinformation is shared among the election noise.

Wrap-Up: Setting the Stage for GE2025

The 2020 General Election was a wake-up call for the PAP, as the Workers’ Party (WP) leveraged strong organisation and digital savvy, while the Progress Singapore Party (PSP) gained traction with its populist rhetoric, despite the PAP ultimately securing a comfortable victory overall. However, those anticipating a repeat of the last GE might be in for a surprise. Post-pandemic normalcy has returned, and the Government has refined its messaging, demonstrating greater resilience even in the face of scandals and controversies. The 4G PAP may prove tougher than many expect.

Yet, challenges remain. Many voters continue to feel the strain of Singapore’s rising cost of living, and not everyone has managed to keep up with the pace of change. As the electorate ages, their expectations around service delivery—particularly in healthcare, community upgrades, and local facilities—are becoming more pronounced, making these areas critical focal points in the lead-up to the election.

Globally, 2025 presents an uncertain economic and political climate, but Singaporeans remain optimistic about their ability to compete and thrive. This optimism may make external factors less relevant than they were during the pandemic, as local issues take precedence in shaping voter priorities.

For Prime Minister Lawrence Wong, the months ahead will mark the ultimate test of his leadership. Thus far, he has confronted the challenges of 2024 head-on and emerged unscathed, positioning the ruling party for another potential electoral success. The spotlight will soon be fully on him and his ability to lead with confidence and deliver results will determine the outcome of GE2025.

Join the Conversation

Our insights have captured attention. Read more below:

Blackbox's Head of Strategy and Marketing, Glenn Wray, discusses our GE2025 insights and their impact for campaign planners on MoneyFM. https://open.spotify.com/episode/3aYW3UnNepNsO9J0eOKsUe?si=2VlwncG2RH-zx4vEDXci2A&nd=1&dlsi=b7530bb452874cba

CNA reports on Blackbox Research data showing that cost of living is the top issue for Singaporeans ahead of GE2025, with more than a quarter still undecided on their vote.

https://www.channelnewsasia.com/listen/daily-cuts/cost-living-tops-singaporeans-concerns-ahead-general-election-4864441?cid=internal_sharetool_iphone_17012025_cnaThe Star covers Blackbox Research findings, revealing that the cost of living is the top concern for voters as GE2025 nears, with 25% still unsure about their vote.

https://www.thestar.com.my/aseanplus/aseanplus-news/2025/01/16/one-in-four-singaporeans-undecided-on-who-to-vote-for-ahead-of-general-election-surveyMalay Mail highlights Blackbox Research data, revealing that cost of living dominates concerns as GE2025 approaches, with many voters uncertain about their choices.

https://www.malaymail.com/news/singapore/2025/01/16/cost-of-living-tops-concerns-for-singaporeans-ahead-of-general-election-one-in-four-undecided-over-support/163434#google_vignetteThe Independent reports Blackbox Research, showing that despite optimism, concerns over living costs and housing affordability shape Singaporeans’ decisions for GE2025.

https://theindependent.sg/cost-of-living-tops-singaporeans-concerns-ahead-of-ge-1-in-4-voters-undecided-on-who-to-support-survey/#google_vignetteThe Online Citizen covers Blackbox Research findings indicating that the cost of living is the key issue for Singaporeans ahead of GE2025, with 75% already confident in their choice.

https://www.theonlinecitizen.com/2025/01/16/survey-cost-of-living-tops-singaporeans-concerns-75-certain-of-their-vote-ahead-of-ge/SCMP shares Blackbox Research data revealing that a quarter of voters remain undecided on their vote for GE2025, with economic concerns leading priorities.

https://sc.mp/b03nz?utm_source=copy-link&utm_campaign=3294981&utm_medium=share_widgetIn another CNA report, Blackbox Research highlights that concerns over cost of living, jobs, and the economy dominate voter priorities, with younger voters being the most uncertain about their electoral choice.

https://www.channelnewsasia.com/singapore/singapore-voter-concerns-general-election-cost-living-inflation-housing-economy-unemployment-4860816